How data can be used to strengthen lead generation and generate new business

Historically, lead generation used to mainly consist of purchasing lists of names, with sales representatives cold-calling or sending out mailshots. However, modern advances in technology and data collection and management have dramatically changed the buying journey and made it possible for companies to generate leads based on specific criteria and information. Collecting and analysing data gives us the potential for far more accurate and fruitful lead generation activities. Today’s customers have a huge amount of information available to them, largely through digital channels including search engines and social media. Well before they make a decision to buy, or even engage with a potential supplier of the product or service that meets their needs, they are able to thoroughly research their options. This means that they are less likely to be prepared to engage with any sort of sales pitch that doesn’t meet their needs. So while modern marketing technology now makes it possible to collect far more detailed information about potential buyers, using data as a marketing lead generation tool, the flip side of that is that you then need to tailor your marketing communications far more accurately to their specific needs, or risk losing their interest. In this article, we’re going to talk about how data can make lead generation more effective, and look at 4 different ways data can be used with lead generation tools to make your sales cycle more efficient. 4 ways data can be used to strengthen lead generation 1. Audience segmentation Data is an essential market research tool, allowing you to hone in on the segmentation of your audience groups and strengthen your lead generation campaigns. Segmentation of your target market allows you to target the right content to the right people, in the right way for them, rather than delivering ‘blanket’ campaigns. Segmenting your campaigns can improve lead generation by enabling you to develop more tailored marketing messages to meet the needs of each audience. Using data to segment your target audience also allows you to choose not just what content you deliver, but how, when and where, making it more probable that your campaign will find people in the right place and at the right time. Data can be used in lead generation to segment the audience by identifying people who meet certain criteria – age, gender, behaviours and interests etc – and deliver marketing campaigns tailored to them, making your lead generation more effective and more targeted. Audiences can be segmented in a number of key ways. Below we will look briefly at the four main types of audience segmentation. It’s important to remember that with the right lead generation software you can create even more niche groups within each broad segment. Demographic Segmentation One of the most basic and common approaches, which segments audiences based on observable, people-based differences; things like age, gender, marital status, occupation, education level, income, race, nationality and religion. Geographic segmentation Geographic segmentation is exactly what it sounds like, dividing your market based on their location – country, region or postcode. Knowing a customer’s location can help you better understand their needs, the likelihood of their buying from you, and enable you to send out location-specific marketing communications. But you can also segment consumers based on the characteristics of their location, such as its climate, the population density or whether the area is urban or rural. Again, understanding their location can help you if you need to target individuals or businesses in a specific area or with a particular need. Behavioural Segmentation Another way to segment your audience is through analysing data that tells you about their behaviours – like their online shopping habits. Gathering and analysing data about the way people use online shopping can help you to design an experience that meets their needs and makes it more likely that they will make a purchase from your site. Data analysis makes it possible for you to track actions on your website – how long do they stay? Do they read information and articles to the end? What kind of content do they click on? Behavioural data is particularly useful because it relates directly to how a customer or potential customer interacts with your brand. This insight can help you market more effectively to them. Psychographic Segmentation Psychographic segmentation deals with characteristics that are more mental and emotional, like personality traits, interests, beliefs, values, attitudes or lifestyles. Understanding them can help you to create content that is more appealing to your audience. While demographics provide the basic facts about WHO your audience is, psychographics give you insights into WHY people decide to purchase from you (or not) or interact with or ignore your content. 2. Use data to understand a business and its key people A helpful way of using data to strengthen lead generation when you’re marketing to a business is to use it to understand more about the company – beyond simply its industry, sector or location. Historically, there have been few ways to gather and analyse deep-dive data and company insights without time-consuming manual research. Our platform can be used to strengthen lead generation by providing almost instantaneous data sets which provide company insights including: key people of influence with the company and its wider networks master directorship records, which to help uncover all businesses related to one key individual employee lists and contact details to enable you to reach out to prospects 3. Use internal data to test, analyse and adjust campaigns Your internal data can be essential in improving lead generation. Carefully gathered and analysed, your own data, gathered through data collection and analytics tools such as Google analytics or your own CRM system, can be used to a/b test the results of different campaigns, and improve your results for better lead generation. Access to insight from your website analytics and CRM data can drive improvements in your marketing messages, the customer experience on your website, and how and where your marketing materials are delivered. You can also use

Solving financial crime, fraud and lending collections risk

mnAI join forces with Grant Thornton to support UK banks as they combat financial crime and fraud To support UK banks as they combat financial crime and fraud, and to offer a solution to these challenges, mnAI has joined forces with leading business and financial adviser Grant Thornton UK LLP. The announcement comes as new research from Experian finds that loan fraud rates rose by 40% in the second quarter of the year, the highest level reported in the last three years. The offering combines Grant Thornton’s expertise in data strategy, data management and analytics with the proprietary data from cutting edge technology provider mnAI. The combined service will provide clients with deep and meaningful insight into UK businesses, which will help to reduce risk, decrease operational expenditure and foster innovation. Learn more about the collaboration click here Niresh Rajah, Managing Director, Head of Data, RegTech & Digital Assurance Practice, Financial Service Group, Grant Thornton, said: “Last year the government introduced a number of initiatives to help businesses during COVID-19 lockdowns, most notably the Bounce Back Loan Scheme (BBLS) and Coronavirus Business Interruption Loan Scheme (CBILS). Despite this intervention, some businesses will sadly not recover, leading to an increase in defaults. Collections and recoveries require specialist skill sets, and lenders will be under pressure to meet demand, while actively preventing fraud and making sure they are treating customers fairly. “Whilst the full exposure of the high street banks has not yet been quantified, the risk posed by those customers likely to default is significant, especially where background data on new customers (e.g., various debt exposure, longevity of relationship with the lender) is not known. Consequently, lenders are seeking to quantify this risk, whilst developing innovative solutions to mitigate and manage their exposure. “Our exciting collaboration with mnAI combines our expertise and capabilities in data management and data analytics to help our clients address these challenges. We are also working together on a number of use cases to support clients to manage risk, combat financial crime and fraud, and to help them to better understand their end customers and make insightful, data driven decisions for revenue growth and better customer service.” John Cushing, CEO at mnAI said: “Using billions of data points, mnAI’s award-winning technology instantly provides uniquely accessible insight for research and due diligence on all unlisted companies in the UK, across sectors, companies, geographies and individuals. From financial crime to real-time gender analysis, our data and technology is helping to power the next generation of business intelligence. “The collaboration with Grant Thornton and the opportunity to share our expertise across a range of industries and sectors is hugely exciting.” Click here to see other mnAI news Looking to learn more about this financial crime data product? Fill out our enquiry form below and we would be happy to discuss.

mnAI and Greengage partner to create real-time UK SME market data

Visualising the UK SME Market in real-time Greengage, the first fully integrated financial services group bridging the traditional financial services space with the new digital innovations in crypto-assets and blockchain, has joined forces with mnAi, to provide their clients with access to millions of real-time data points across all UK business sectors. Adding access to rich data surrounding SMEs in the UK, will open up this information to their clients, to provide more informed decision-making. Greengage is a digital finance pioneer that provides a platform of relationship-based e-money account services to entrepreneurs, SMEs, family offices, and digital asset firms to the highest ethical, secure and compliance standards. Alongside our account services, we provide clients access to a B2B lending platform offering digital sources of money. Our tailored services are delivered by people, empowered by technology. CEO of Greengage, Sean Kiernan, commented: “Greengage are facilitating access to the mnAI SME data and analysis to help provide additional insights into the important SME sector, and to start discussions with potential interested partners to address the £22bn+ SME funding gap as highlighted by the Bank of England”. [3] mnAI CEO, John Cushing, added: “We’re delighted to work with Greengage. The collaboration is an excellent opportunity to showcase not only the power of mnAI, but also the services that Greengage offers to their clients, and we’re excited to be part of their journey as they continue to grow.” You can access the data made available by this partnership here Learn more about how mnAI has powered insight previously for Greengage here [1] Coinmarketcap: ” Today’s Cryptocurrency Prices by Market Cap,” last accessed 8 July 2021, https://coinmarketcap.com/ [2] Cambridge Centre for Alternative Finance: “3rd Global Cryptoasset Benchmarking Study,” (September 2020), https://www.jbs.cam.ac.uk/faculty-research/centres/alternative-finance/publications/3rd-global-cryptoasset-benchmarking-study/ [3] Bank of England: “An open platform for SME finance,” (June 2019), https://www.bankofengland.co.uk/-/media/boe/files/research/an-open-platform-for-sme-finance

The Gender Index

Jill Pay and mnAI to create the first UK female entrepreneurship benchmark report Jill Pay and mnAI announce the creation of the UK’s first and largest UK female entrepreneurship report The Gender Index is being created to form a benchmark of the current level of activity undertaken by SMEs across the UK that are owned and led by female founders. The inaugural report will cover 8m companies and over 12.8 million people. It will be the largest report of its kind ever produced for the UK, with the ambition of setting the standard for gender-disaggregated reporting. The report is being formulated as we speak, and will be launched on International Women’s Day in 2022 to celebrate the step forward in female entrepreneurship recognition. Using real-time information from the award-winning data technology provider, mnAI, The Gender Index will: Identify the gender gap between male and female company founders nationally by country, region, county, LEP, and across sectors. Understand the economic impact of female-owned and led businesses on a local and national basis. Understand the impact that venture capital has on female founders. Make this information public to ensure that greater support is provided to female-founded companies, helping to accelerate corporate growth. Establish the metrics and protocols required to track future growth simply and easily. Provide a framework that can collate international data. Chairman of The Gender Index, Jill Pay, said: “Mapping the impact that female-founded businesses have on the UK economy, uncovering their potential and supporting their growth is paramount to a more inclusive, diverse and stronger economy, yet until now, the ability to do so has remained stubbornly out of reach. The collaboration with mnAI to produce The Gender Index changes this. We now have the ability to map every business in every village, town, city, region and local authority across the UK, by sector, in real-time, and crucially, to support those who need it most in these uncertain times.” For mnAI, CEO, John Cushing: “The creation of The Gender Index marks a significant milestone in the support provided to female business owners, and we’re delighted to collaborate on this incredible initiative.” Learn more about this innovative UK female entrepreneurship report at www.thegenderindex.com

21.02 mnAI Platform Update

Our latest platform update 21.02 is now live for all users. In this latest release we wanted to greatly enhance the user experience by providing our users with search results in rapid time, from building lists of potential target companies to generating industry market maps, we have now ensured you get lightning fast results with increased accuracy. If you are new to us or want to explore mnAI for you or your team please contact us at sales@mnai.tech to book a demo. Missed our last update? Learn about our 21.01 release here

Catalyst South LEPs to use mnAI to identify female business owners across the UK

Harnessing AI to identify female business owners Catalyst South is an alliance of six Local Enterprise Partnerships (LEPs) who are piloting the use of mnAI to identify, approach and engage with female-led businesses across the South. Looking ahead to ways that LEPs can improve and target their support to women-owned businesses in different sectors, the Coast to Capital LEP has been piloting AI data analysis technology, “mnAI’s data allows us to identify businesses on our doorstep with great growth potential and reach out to them with information on grants, support, mentoring and events available through our Growth Hubs. It removes the unintentional barriers.” Powered by mnAI, the platform will unlock new opportunities to support businesses including: a deeper understanding of the number of female-led businesses across different geographies and sectors providing baseline analysis by geography and sector on Growth Hub engagement with women led businesses using data to ensure equal business support opportunities are provided the ability to work collaboratively with partners to engage with women led businesses As Chair of Coast to Capital LEP, Julie Kapsalis has one overriding priority: “I want to make a step change in the way we address equality and diversity. The Rose Review tells us that female businesses could generate an extra £250 billion of value. I passionately believe we need to create a true level playing field for women to access our networks, support and finance.” mnAI data helps Coast to Capital identify businesses, and gives rapid insights into local trends in far greater detail than is possible by conventional means. John Cushing of mnAI explains: “Our machine learning algorithms track gender diversity across all UK boards and shareholders, with interactive results available at a click. They give our clients the ability to be proactive: to track regional or local trends and to identify particular needles in the haystack – young female founders under 30 say, or all female-owned businesses in a particular sector. These data and analyses help LEPs to achieve their goals.” https://www.youtube.com/watch?v=mPHE2vLOTqE Learn more about our gender technology by clicking here

Jill Pay joins mnAI, as they pursue gender equality in business

mnAI is delighted to announce the appointment of our new non-executive director, Jill Pay. Together, mnAI and Jill hope to transform the way in which under-represented and disadvantaged business groups are identified and supported using their state-of-the-art data platform, providing billions of data points on women-owned and led businesses at a national level. Bucking the trend and breaking gender norms is something Jill has pursued throughout her career. Firstly as the Head Office Keeper and then in a number of other positions in the House of Commons, Jill famously went on to become the Serjeant at Arms, the first woman to do so, a role she held for four years. Since leaving Parliament, she has held a number of senior roles for organisations including the children’s literacy charity, Coram Beanstalk, the women’s business network Savvitas Global and the Women and Enterprise All Party Parliamentary Group chaired by Craig Tracey MP. Speaking on her appointment, Jill had this to say: “John and the executive have some very ambitious plans for the business that closely align to my core values. With a remit that includes the ongoing development of our Gender Disaggregated technology and with the addition of international data into the platform, it’s a hugely exciting time and I am delighted to have joined mnAI at a pivotal point in their growth.” For mnAI, CEO John Cushing agreed: “We are thrilled to welcome Jill as our first Non-Executive Director to the Board. With a number of landmark developments in the pipeline, Jill brings an unrivalled wealth of experience and passion in supporting the female entrepreneur community adding significant value to the board and company.” Learn more about our gender technology by clicking here Learn more about mnAI NED Jill Pay here

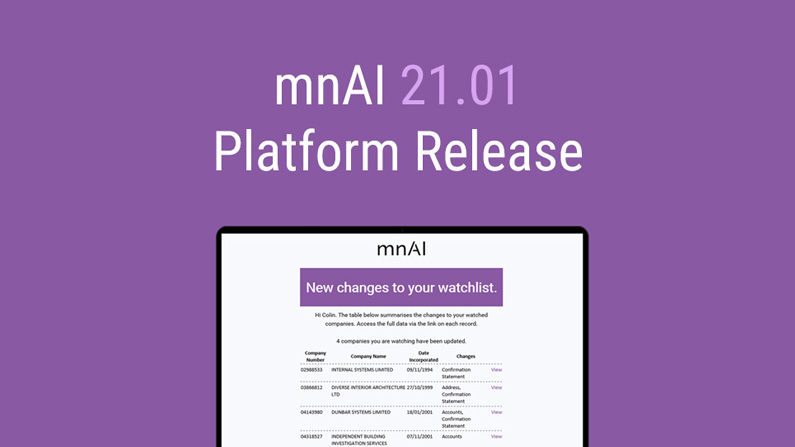

Company Watchlists feature

Our latest platform update 21.01 is now live for all users. This update brings a host of new visual changes, new features and better performance to provide a greater experience. If you are new to us or want to explore mnAI for you or your team please contact us at sales@mnai.tech to book a demo. Missed our last update? Learn about our 20.12 release here.

December 2020 platform update

Our latest platform update 20.12 is now live for all users. This update brings a host of new visual changes, new features and better performance to provide a greater experience. If you are new to us or want to explore mnAI for you or your team please contact us at sales@mnai.tech to book a demo.

Gender diversity technology

Despite the focus on female entrepreneurship over the last two years, the process of Gender identification within the UK company ecosystem is still frustratingly manual and time consuming – up until now. Gatwick based data company, mnAI, has developed machine learning algorithms that track the gender diversity of every UK company by director, officer, and shareholder in real-time, with 9.5bn data points covering over 7m+ UK companies. As an award-winning technology provider and largest UK source for company data, we are committed to identifying, supporting and promoting female leadership and entrepreneurship. We provide uniquely accessible insight and analysis across industries, sectors and geographies; from the analysis of entire investment or customer portfolios to national and local government initiatives. Due to our cutting edge technology, what would usually take months of manual research, can be discovered and converted into easily accessible visual data within minutes. Read more about our new initiative The Gender Index by clicking here.

How AI accelerates family office deal origination

Family Office Investment Family offices are now the fastest growing body of investors in emerging technologies. So, how do family offices reduce operational pains? The last decade has seen significant uncertainty across the financial markets thanks to increasing economic tensions; so much so that many family offices are now shoring up their operations to protect them for future generations to come. In fact, nearly half (42%) of family offices are realigning their investment strategies to focus on capitalizing opportunistic investments in order to mitigate risk, according to the latest UBS/Campden global family office report. This strategy is working – family offices are now the fastest growing body of investors in emerging technologies. From 2015, a record-breaking $5bn was invested in early-stage technology companies. There is clear appetite from executives, with nearly nine in 10 (86%) predicting that artificial intelligence (AI) will be the biggest disruptive force in business throughout the world. Over half (57%) also believe blockchain technology will profoundly impact how investments are managed.

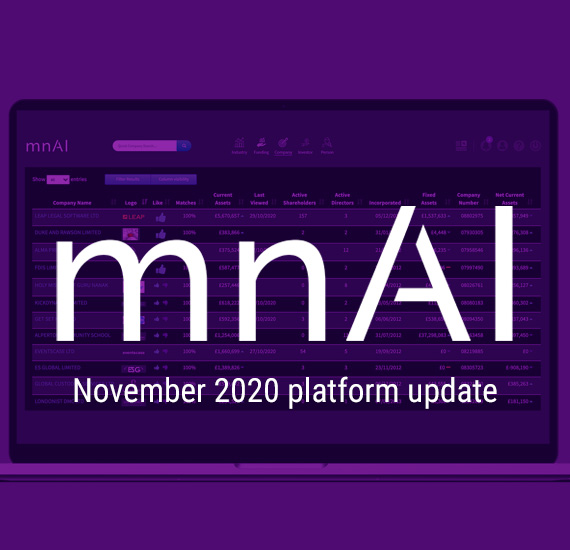

November 2020 platform update

Our latest platform update 20.11 is now live for all users. This update brings a host of new visual changes, new features and better performance to provide a greater experience. If you are new to us or want to explore mnAI for you or your team please contact us at sales@mnai.tech to book a demo.