Making a better way to look at data

In a data-saturated world, true value comes from insight into data rather than simply access to it. John Cushing explains how this understanding led to the creation of mnAi Companies are organisations that can be described in any number of ways, from what they do or sell to how they operate and are organised. For the purpose of this blog, let’s zoom in on the fundamentals of how they go about expanding: Every company wants new customers Every company would like more data on their existing customers Everybody wants to get this as fast as possible While those seem to be simple, achievable goals, there are several stumbling blocks, not least the sheer volume of data currently available. According to Statista, the amount of data created, captured, copied and consumed worldwide rose from two zettabytes in 2010 – each zettabyte being a trillion gigabytes – to 97 zettabytes by 2022. Given that it’s predicted to almost double to 181 zettabytes by 2025, it’s clear that accessing data isn’t the same as obtaining data that’s useful to your company. A second issue is sourcing data when it’s deposited in so many different silos. Over the last 15 years, as I grew various businesses, I acquired private companies based mostly on whatever insights I could derive from long hours creating spreadsheets based on Google searches. This ‘deal origination’ was not only time-consuming, it was also costly and painful. Yet to my surprise, when I subsequently spent some time working for a major UK company, I found that it was operating in exactly the same fashion. Even with their global reach, they couldn’t easily identify companies of interest any more effectively than I’d been able to. Compounding this second issue is the third – a lack of structure to information about private businesses. It’s just wherever it is – on a website, as a PDF or Word document, as a filing to a government agency and so on. Companies House, the UK government’s registrar of private businesses, requires information in around 400 different document types, which should give you a sense of the scale of this issue. mnAi was created to make due diligence on private UK companies not only easier but also more thorough, efficient and meaningful. We did this by not just identifying the data required but also by developing the underlying systems capable of ingesting, formatting and aggregating that data. We did it by creating ways to visualise search results, because data is meaningless unless you can easily understand how a certain company fits into the larger business landscape. Technology is never going to replace that final mile of eyeballing a potential acquisition, supplier or customer but what it can do is speed up and simplify the process. In doing so, mnAi helps businesses and organisations acquire new assets and customers, provides additional information on existing customers and does so at scale with time and cost savings impossible without such end-to-end automation. This is what mnAi does. We’ll get into how it does it next time. mnAi.tech

Making sense of ‘too much’ data

For professional sectors such as accountancy, insurance and the legal profession, digitalisation has made data freely available, yet its interpretation often remains stubbornly analogue. In the current age of real-time updates and digitalisation, professional services risk being drowned by raw data yet starved for usable information. While it can be a struggle to make sense of it all, for sectors such as finance, accounting and law that are governed both by data and well-defined internal processes, artificial intelligence (AI) offers many automation opportunities. The drivers for change are the greater speed, accuracy and volume capabilities of computers when compared to their human counterparts. AI can be a tool perfectly suited for extracting meaning from massive data sets by storing and accessing them without losing, misinterpreting or misplacing anything. AI can do this all day and night, without ever losing objectivity or focus. That’s why many businesses are already using robotic process automation systems to crunch numbers and sift data. For example, kensho.com is an intelligent computer system widely used by stock traders and investors to automatically analyse portfolio performance and predict market changes. The software claims to be “the world’s first computational knowledge engine for the financial industry” and it’s designed to address Wall Street’s greatest challenge – automating and improving on previously human-intensive knowledge work to keep up with the split-second changeability of stock. Robert Dale, chief technology officer at Arria NLG, says: “By emulating human behaviour in software, you get technology that can carry out tasks that are more than just straightforward number crunching, with the machine exhibiting real intelligence. But you also get all the benefits of it being done by software – it’s incredibly fast, incredibly consistent and it’s available 24/7.” The finance sector can derive particular advantage from this. An AI system can react and adjust for changes to an economy on the other side of the planet while its company’s human employees sleep. It can also save days of historical data analysis by scanning reports and compiling results in seconds. Yet AI systems don’t just represent faster versions of existing workers – they can can also transcend human capabilities by spotting weaker, more widely spread or more complex patterns than any number of operators ever could. A financial analyst – even the most experienced one – won’t recognise a never-before seen trend if they don’t know they should be looking for it. By searching for patterns in raw data, that’s precisely what AI is capable of. Most business sectors could benefit from completing processes faster, cheaper or more consistently – that’s the driving force of automation. Yet AI tools provide analytical capabilities far beyond cost benefits. For the legal profession, for example, an AI tool can take seconds to summarise the key points of a document using natural, easy-to understand language. In finance, AI can create graphics that demonstrate clusters of opportunity or risk that no one knew to even look for. Artificial Intelligence can replicate human expertise and scale it by analysing larger data sets, more quickly and more thoroughly. It can do so without the unconscious bias inherent in human decision-making and without the loss of ability due to repetition or fatigue. This rapid advancement can only be supported through the use of machine learning, cloud native technology such as that developed and employed by mnAi. For users of mnAi’s platform, the tools provided already complement existing technologies to support the deal origination, due diligence, KYC and KYB processes. For data users, mnAi’s pre-formatted, ready-to-ingest data provides the perfect opportunity to augment incumbent data structures. With 12bn data points covering 9.5m UK companies, mnAi is a multi-award-winning producer of proprietary data and technology that supplies unique analytics and due diligence on all UK companies. Updated in real-time, mnAi is the trusted partner to professional and financial service providers, investors and government supplying data-driven insights into fields as diverse as fraud, risk, business emissions, insurance, investment and wealth management.

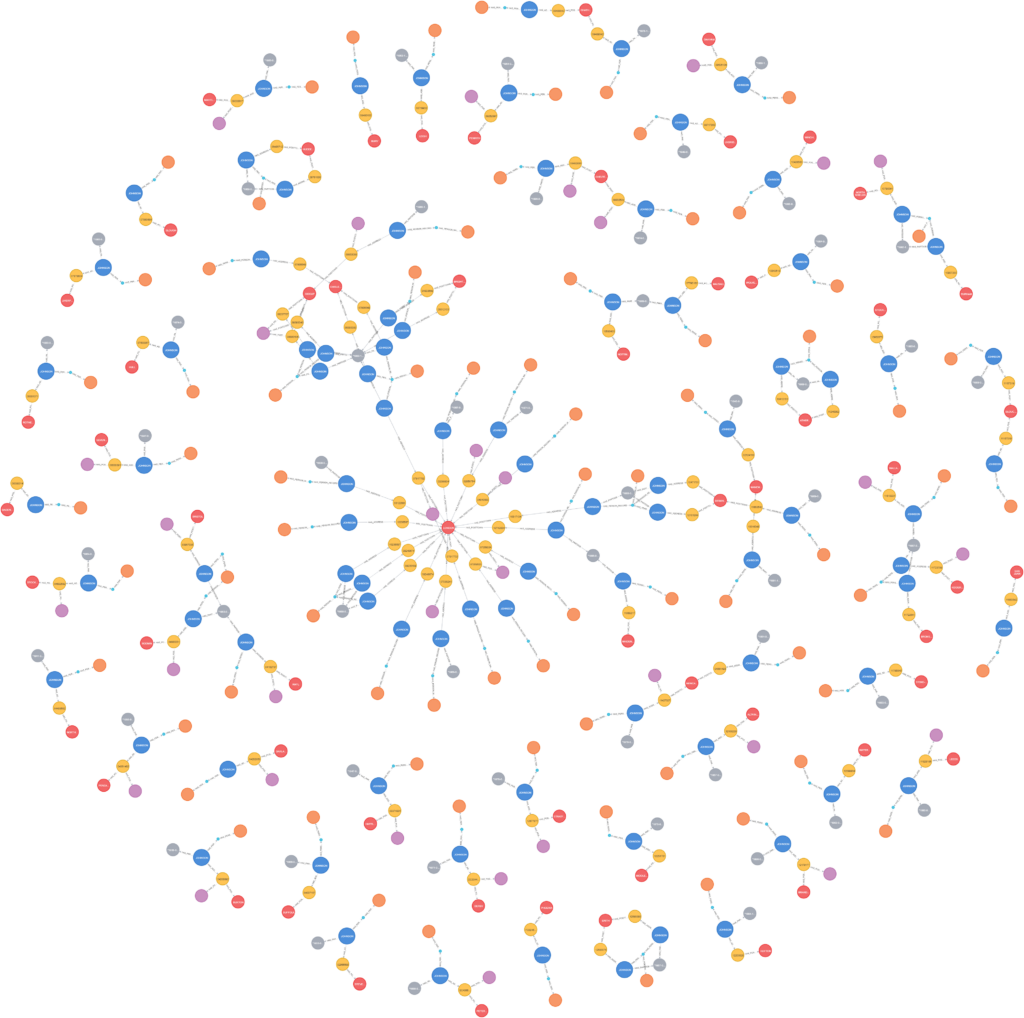

Basic entity resolution using graphs

As a reminder mnAi is leading the way in transforming unmanageable company datasets into meaningful data networks to uncover high-value insights. For instance, we have connected all UK companies, company officers and shareholders- a network of close to 100m relationships — to identify fraud and sales opportunities (among lots of other use cases). The data model is based on the ‘POLE’ methodology (People, Object, Location, Event) which has a long history in criminal investigations. If you’ve ever watched a crime series you will be familiar — it’s that big whiteboard at the back of the room with mugshots and places of interest connected with a mishmash of connecting lines. Due to the number of entities we track — some 21 million companies and 12 million company officers — we’ve done away with the whiteboard and use a database designed specifically for the task (if you are completely new to the concept of a graph database I suggest this 2 min intro). The point of maintaining company data in this way is to enable network analysis which often uncovers things conventional approaches can not or which take them far too long to accomplish. In our domain, one of the initial analyses is ‘entity resolution’ which answers questions such as: Have we got the right person? Are we sure we have all the information possible about them? Do they have aliases (via intentional obfuscation or honest error)? When a dataset is small you can perhaps tackle this manually or with Excel, or with a relational DB when the data gets larger. In either case, you will soon get frustrated with the time it takes to answer the apparently simple questions above. Compounding that frustration is the inescapable fact that any subsequent analysis will be based on the assumption you do indeed have the right person and the correct information about them. If not then your inputs are tainted and your findings will have blind spots. This causes the ‘we missed it’ line in the crime drama which ensures a second series. Enter the graph. Rather than only focusing on the information about things graph databases provide equal weight to the information about the relationships between things and can do so quickly at scale. Will The Real Thomas Johnson Please Stand Up? So let’s get to a concrete example. The image at the start of this article is a query I ran in our database which, in simple terms, says: “Show me all the directors called Thomas Johnson along with the companies they’re associated with, places they lived and their dates of birth.” Rather than return results as text in a table we return them as connected nodes. Let’s take a closer look at what we found. Blue and orange nodes are company officers, yellow companies, red and purple locations and grey dates of birth. In the middle is a spider web shape with a red node ‘London’ at its centre. These are all the Thomas Johnsons with a present or past address in London. Just above and to the left is a cluster of nodes which does not look like the others — what’s going on here? That cluster is held together by the date of birth but also shows 7 companies spread across 3 cities and 3 separate ‘Companies House’ master records. Without the date of birth holding everything together, this cluster would have split out and looked like the rest, essentially hiding the true story. A next step, once we collect all the name, address, date and location data for our POI (person of interest) is to run subsequent queries to see if there are possible aliases or obscured connections. For example, show me: “all the people with that date of birth who ever lived at that post code” “all the companies incorporated around those dates in those towns” “with a fuzzy match of the name, any more connected companies” Next Steps This introduction to basic entity resolution using graphs showcases a simple visual analysis approach. In future articles, I will attempt to apply some higher-level graph voodoo such as: Profiling cluster shapes to find matches within the other 12m million directors; identifying others with similar conduct Use weights from clusters shapes as input to train ML models to predict director behaviour. Mike Oaten, Head of Connected Data, mnAI

mnAi makes the ESGFinTech100 2022

We’re delighted to announce that mnAi has been listed as one of the most innovative ESG companies in the world by FinTech Global. As the leading platform for UK-based company data, we’re pleased that the hard work of our developers, designers, programmers and everyone else is being recognised internationally and that the mnAi platform is getting the attention, we feel it rightly deserves. The ESGFinTech100 is an annual list highlighting the most innovative companies that offer solutions for the financial services industry and is selected by a panel of experts. To compose the list, the Advisory Board and FinTech Global team consider a range of criteria including: the industry significance of the problem being solved, growth in terms of capital raised and the innovation of the ESG technology solution offered. mnAi provides unrivalled UK private company data available through api, platform or integrated solutions. With 12bn+ data points, mnAi’s core product is a data asset encompassing 9m+ UK companies and 37m+ people that is updated and refreshed in real-time. Commenting on the accolade, mnAi CEO John Cushing said: “In recent years the mnAi platform has grown and dramatically expanded in capability to provide what we feel is the world’s best platform for data and analytics on UK companies and directors. We are delighted for this to be recognised by Fintech Global and to see mnAi make the ESGFinTech100 2022 list, among so many other great companies.” FinTech Global director Richard Sachar said “The ESGFinTech100 list helps senior management filter through all the solution providers in the market by highlighting the most innovative ESG tech companies in areas such as ESG Assessment & Reporting, Regulatory Change Management, ESG Intelligence & Data Analysis, Supply Chain Screening and Banking & Investment products.” To check out the full list click here.

mnAI data reveals just 0.1% of companies in some sectors led by women

Understanding the gender make-up of the UK’s business landscape is an invaluable asset, with applications for investment and equality monitoring that is relevant to a wide array of users including those in the government, investment and financial/ professional services industries. The mnAI platform provides a variety of tools to slice and dice gender data to reveal stark insights. This can be done by director, company or by other valuable metrics such as gender, age, location, investment history or capital. Gender data: Just 2% of financial services companies are founded by women Using the mnAI platform to analyse the gender make up of majority-female founded companies reveals that just 2% in the financial services sector are female-led. While this percentage sounds small it is diminished by the 0.1% of companies in the energy sector that have a majority female board. Government Tenders Another interesting tranche of added data regards government tenders, with new searchable businesses information – who government tenders have been awarded too, when, and a description of the actual tender itself along with its status and how much it was worth. It’s also possible to see who has awarded them, such as Local Enterprise Networks, so search can be carried out by which regions are awarding tenders and to who. Private equity funds back just 159 female led companies nationwide: Using the mnAI platform it’s possible to view the macro makeup of all of the UK’s 7,760 private equity funded companies, only 2.5% of them have a female led or majority female board. The data can be further segmented and compartmentalised to reveal who these female founders are and what their other business interests might be. If we turn this data on its head and look at the make-up of the actual private equity companies themselves, we can see that 461 are male led, whereas just 39 are led by a predominately female board. Conversely 113 private equity firms are led by either a gender-neutral board. Of the 613 private equity companies, there are a total of 1,478 officers — of which only 208 (14%) are female. Taking a deeper dive into this, it is possible for users to identify if these companies are more likely in turn to invest in female founded companies. The average turnover of male led companies is double that of female for companies in excess of £30m turnover Taking a dive into turnover we can see that on average male-led companies have a turnover in excess of £30 million whereas female-led companies turnover less than half of this on average at £12.8 million. It’s important to note at this point there is a reporting bias, as companies with a turnover of less than 10 million are not legally required to publicise this data. To further your own research in the quickest, smartest ways on the mnAI data tech insight platform, then please get in touch with our Managing Director, Ricky.Cowan.

mnAI: CCJ and Government Tender Data

Getting to get to grips with CCJ and government grant data can be a valuable part of building a well-researched company profile. With mnAI’s most recent platform update, we’ve added even more layers to help on company data search journeys, so that there’s no need to pull data together from multiple databases. Below we take a deeper look at the biggest updates, detailing how they are able to further enrich data-dives… County Court Judgement data Bringing in a wealth of new data to the mnAI platform, Country Court Judgements are now fully searchable. Sitting on the platform initially under the ‘Secure Debt’ header, there’s the ability to search not only for whether a company has received – or currently has – a judgment, but also the dates that the CCJ was registered, and the value of the judgment as well. This helps when specifically targeting companies with high- or low-value judgments. Elsewhere on the platform, the CCJ information is also accessible on individual company profiles, enabling for a quick view or registered judgments. In the debt and borrowing feature there are specifics about the data, such as what the judgment is, how much it’s worth, when it was filed and its current status. This helps with a bigger picture view, detailing information specifically about an individual judgment, when carrying out a search as part of a defined landscape from where more specific parameters can be investigated. In conjunction with all the mnAI variables, it’s possible to create detailed, in-depth insight when getting to know a company more deeply with information around specific businesses, groups, areas, or even locations, so that users can make a better appraisal of a situation. The County Court Judgment data allows a picture to be painted of a situation, looking at the affordability of a company as part of wider information gathering. This can also be applied to an individual director or group of directors who might have associations with other companies. The CCJ data on the mnAI platforms is a live feed, meaning that there’s no reliance on pulling data from any other kind of provider – all data is in one place – so potentially researchers can be the first to see that information for a company. This takes away the manual aspect too, meaning no more scrolling an xl sheet – information can be saved out as it’s wanted, creating unique data sets. The potential to build hot leads through a very tailored approach is high. Government Tenders Another interesting tranche of added data regards government tenders, with new searchable businesses information – who government tenders have been awarded too, when, and a description of the actual tender itself along with its status and how much it was worth. It’s also possible to see who has awarded them, such as Local Enterprise Networks, so search can be carried out by which regions are awarding tenders and to who. Company search look and function Basic changes to how the company search looks and functions have also been implemented, specifically adding in more columns, enabling users to answer more questions a lot faster about a company subset. So, for example, employee count can be added as a column, meaning companies can be sorted and ranked by employee count, net assets and/or turnover. Speed and performance Lastly, we regularly issue updates for platform speed and performance, to keep it working at its optimum. To further your own research in the quickest, smartest ways on the mnAI data tech insight platform, then please get in touch with our Managing Director, Ricky.Cowan.

mnAI: data tech insight platform

With the aim of reducing the time it takes from months to minutes for investors, companies, or individuals to understand an industry, companies, company directors or shareholders, mnAI has all the data you’ll ever need. The idea of data powering everyday lives has never been more prevalent in the public consciousness than it is right now, and that’s only going to become more intrinsic as we move into the future. At mnAI, we set out with a clear mission: to focus on a clearly defined market and make it easier and quicker to use data through our platform to help shape and inform critical decision making for companies. The Platform 2.0 Our platform is a single source of unified data, holding 10bn+ data points on 8m+ UK companies, which allows users to access targeting information rapidly via a wide range of machine learning algorithms and filters. We deliver rich, real-time information on UK companies through an intuitive, engaging platform interface, which is about to become even better to use with the launch of our 2.0 version. This will make it even easier to use, presenting the data that our clients are after in a clearer, more focussed environment, meaning that clients will be able to take data loads from the platform and insert them straight into presentations – even on the fly. Data Topics Our clients range from devolved and local government, professional & financial services to journalism & media, academia, and investors. They come to us for the wide-range of data we’re able to provide – including what many consider to be hot topics right now: – Gender (Director and Company Ownership) – Age (Director and Company) – Covid (Companies in receipt of Covid funding) – Furlough (Companies in receipt of Furlough funding) – Financials (all balance sheet and P&L lines, bankers, advisors etc) – Innovate UK (Companies in receipt of Innovate UK Grants) – Import / Export (Companies who import/export) – Family owned (Companies that are family owned) – Land & property ownership (Companies who own Commercial Land of properties) All of this can help Merger & Acquisition teams to identify new opportunities, accelerate deal origination and support due diligence via the quick and easy to use platform interface. Then we can visually bring to life every UK industry using our proprietary insight technology, which tracks all UK sectors on a macro and micro level in real-time. Our company search facility has 350+ different variables, allowing you to quickly and easily find companies that meet your exact target criteria. Every industry and sector visualised From identifying growth hot spots to sector analysis, our UK industry data technology gives you complete insight into every industry and sector, helping to power our clients research and decision making – without the manual work. With our insight technology across sectors, industries, and geographies, mnAI instantly generates in-depth, real time market analysis with amalgamated financials, growth rates, heat-maps, and genders, so that our clients can visually build and control the data in a way that makes sense to them – we also have interactive charts and maps too. Fast sector analysis allows clients to discover the changing industrial landscape within a search, as real-time company information and numbers are tracked back over five years, giving an instant understanding of sectoral activity. Through numerous location filers, clients can drill down into all UK regions, enabling their investigations to be carried out to a granular level: such as with postcode options, economic regions, and even free-draw mapping – which tends to become very addictive once discovered! Gender analysis With gender becoming an ever-greater focus, mnAI allows users to further their understanding of how gender plays a role in search-defined companies. The machine learning algorithms track gender diversity across all UK boards and shareholders. Thanks to its billions of data points, mnAI makes it easy to identify all female founded companies, for example, with every UK industry and company mapped. This can enable users to visualise diversity, identify and monitor trends, hotspots, and activity, as well as create instant gender market maps. Track capital-raising companies mnAI lets users track thousands of UK-based companies raising capital – and their investors – with easily discoverable data on 500,000+ companies over the last 10 years, as well as potential upcoming raises. With the platform’s proprietary algorithms and search facility, users can rapidly identify investors across industry, sector, geography or even size and stage of investment. Users can also view unique insight into the investment ecosystem, from identification of companies that have raised capital to those that may need more, as well as investors most active in the space, and valuation changes over time. Person search Through our platform, it’s easy to target prospects and leads with precise person searching, harnessing over 175 variables to quickly and easily identify individuals that meet exacting criteria. We can access millions of UK officers, including director, shareholders, and other high net worth individuals, from where users can do a deep dive into their history, across themes such as all known board seats, shareholdings, industry of activity, visual connections, gender and much more. This enables users to combine mnAI’s AI powered search platform with enhanced due-diligence, creating the perfect go-to for any acquisition strategy. To further your own research and due diligence in the quickest, easiest way on the mnAI data tech insight platform, then please get in touch with our Managing Director, Ricky Cowan and our sales team Ricky.Cowan@mnai.tech.

April 2022 Platform Release

Our latest platform update is now live for all users. In our latest release, users benefit from a host of visual changes, features, and enhanced data sets. If you are new to us, or would like to explore mnAI further please contact us at sales@mnai.tech alternatively you can book a demo by clicking here.

February 2022 Platform Release

Our latest platform update is now live for all users. In our latest release, users benefit from a host of visual changes, features, and enhanced data sets. If you are new to us, or would like to explore mnAI further please contact us at sales@mnai.tech alternatively you can book a demo by clicking here.

4 ways data can help accountants with lead generation

Lead generation for accountants used to mainly consist of buying lists of names, or spending many hours at networking events trying to meet people and build the relationships that might persuade them to move their business to you. But, modern advances have made it possible for companies to generate leads based on specific criteria and information using large data sets. It has also made it possible to analyse information in your target market and create marketing communications that speak directly to your potential customers on topics that they are already interested in. 4 ways that accountants can use data for effective B2B lead generation: 1. Using data to establish thought leadership Thought leadership content is high-level content (white papers, blog posts, videos or any other form of content ). Whichever form it takes, for your content to be considered thought leadership it must be well-researched, relevant to your particular industry and full of insights on the topic. Done well, thought leadership content can help you to build your credibility by demonstrating your knowledge and experience to your target market. In today’s digital world, social platforms are becoming increasingly important, and your thought leadership blogs and articles can be spread far beyond your own website or blog platform. Data can give you insights for these thought leadership and blog articles. Using data, you can identify trends or challenges which impact your audiences business, or find topics which may interest or inspire them. You can also use data to identify important questions which your audiences are asking about their sector, or about developments or changes in taxation (for example) which may affect how they manage, structure or grow their business. Being a thought leader in your industry can also help you to increase awareness of your brand. Widely shared and commented on articles (via LinkedIn, or platforms specific to the industries your target clients operate within) enables you not only to build your credibility, but to engage in conversations which build relationships and trust. 2. Using data to monitor the competition Data is a useful tool to help accountants monitor their competitor’s activity. With the right data, you can identify industries where companies are pulling out of a particular market. If these companies are your competitors, you can use data to assess why this may be, and whether this presents an opportunity for you to move in. By collecting and analysing performance data, you can also identify where your competitors may be falling short of expectations and not providing the best service to their customers (your potential customers!) 3. Use data for business development Data can help accountants with lead generation by providing them with the research they need for business development. One of the challenges of lead generation is narrowing down lists of potential prospects to ensure you are targeting the right businesses. With the right data sets, you can generate highly targeted and focussed lists of companies to enable your sales team to concentrate on their efforts on the right leads. Using data to search for companies in certain geographical areas, industries or sectors allows you to focus your activities on the areas which best match your accountancy firm’s customer criteria. mnAI gives you access to a wide range of data in minutes – you can choose from hundreds of different search criteria to target your search by region or area, by industry, by company size or growth stage or by director to generate a list of companies and people to engage with. 4. Use data to search by specific criteria Data can help accountants generate highly specific lists of potential target companies that meet certain criteria. Making your list of leads specific can save you a huge amount of (potentially wasted) time and effort spent reaching out to the wrong people, or companies – who either don’t fit the profile of your ideal customer, or who aren’t in a position to become warm leads. As well as region or sector, there may well be additional criteria that you want to apply to your list of potential leads. You may wish to target companies by very specific criteria such as size, turnover, growth or even the gender of key directors. How mnAI can help with lead generation for accountants mnAI’s unique, award-winning data platform enables accountants to create a target list by searching for companies based on specific criteria. Whilst there are other sources of data available, mnAI provides a single source data platform, and its sophisticated search capabilities and speed take the legwork out of collating and analysing multiple data sets. Historically, you needed to collect and collate data from a number of different sources (eg Companies House) – a time consuming and largely manual task. Replacing older, often very time-intensive search methods, mnAI enables you to build target lists in minutes instead of days, eliminating the need for hours of manual collation and analysis of data. Results are presented in a simple to read dashboard, and our unique visualisation technology reveals your area’s business landscape in detail. With millions of data points added every week, you can be confident the picture you are seeing is in real time: up-to-date and accurate. With over 350 search variables, users can easily identify companies that meet their exact criteria. From anticipated financial growth, specific director gender or age, location or sector, mnAI helps local governments to develop a deeper understanding of their local business communities, and gain strategic insights into the priority sectors and sub-sectors in each borough or LEP. It’s currently the only platform which can identify the gender of the founders, directors and shareholders of over 7 million UK companies, and its billions of data points mean that searches can be detailed and focussed on specific sectors, business types and areas. You can search to see who your competitors’ clients are; so if you know they are pulling out of a particular market, or are aware of shortcomings in their customer service levels, you can quickly and easily

How Local Authorities can use data to achieve their objectives

In today’s technology-driven world, businesses and organisations, large and small, are rapidly learning how data can deliver insights into their customers’ preferences and behaviours, and drive strategic business decisions. Sources of data abound, and the challenge is often not how to gather it, but how to analyse and use it. The usefulness of data isn’t limited to commercial, entrepreneurial companies, though. Local authorities are increasingly recognising the value of data to enable them to streamline their processes, drive better engagement with their communities and deliver services more efficiently. Why data is useful for local authorities? Data can provide a number of benefits to local authorities. The Covid-19 pandemic has created unprecedented challenges for local authorities and other government departments, as well as for businesses and individuals. Since the onset of the Covid-19 pandemic, many councils have reported that better use of their local authority data has been an important element in helping them to respond effectively to the challenges it presented. According to a report by the Centre for Data Ethics and Innovation (CDEI), which surveyed 12 local authorities and organisations, local authorities have found that collecting and using data more effectively has enabled them to: Identify those most clinically and economically vulnerable to the effects of COVID-19 Predict demand and pressures on local services; Inform direct public health responses to COVID-19 outbreaks, including local-level; Collaborate on NHS Test and Trace. In addition to putting in place measures to support local services and protect individuals, since the first lockdown began in March 2020, local authorities have been forced to take action to support local businesses. Better use of data can help local authorities to build strategies and actions plans based on real insight into their business community, enabling them to target companies most in need of their support. With data sets that allow them to identify businesses segmented by district, borough and sector, local authorities can be highly specific and targeted with their support. How local authorities, through Local Enterprise Partnerships, can use data to support business Effective acquisition and analysis allows local authorities to prioritise work with the sectors and businesses that are most in need of their support. It allows them to set their performance targets based on data, to ensure they are publicising and making their services are most accessible to those in greatest need – whether from a business or social perspective. Local Enterprise Partnerships in the UK (LEPs) can build their work programmes based on the insight gleaned from detailed local business data, accurately identifying businesses with growth potential and proactively engaging with them with information on grants, support, mentoring and events available through their Growth Hubs. Data can also provide much greater insight into gender leadership diversity, allowing local authorities to develop a strategy for future engagement. How data promotes support for female entrepreneurship The rise in women starting businesses during the Covid-19 pandemic has been widely reported in the UK media (see The Guardian for just one example), yet it’s also a fact that female entrepreneurs are far less likely to achieve investment from angels or other funders than their male counterparts – particularly in companies with all-female boards. The ability to segment businesses by district, borough and sector allows local authorities to compare the proportion of women-led businesses they have supported compared with the proportion of women-led business across all registered businesses, allowing them to check that they are meeting their targets for supporting diversity within their regions, and adjust their approach if they are not. Coast to Capital piloted the use of mnAI for engaging with women-led businesses in their regions Julie Kapsalis, the chair of Coast to Capital said: “I want to make a step change in the way we address equality and diversity. The Rose Review tells us that female businesses could generate an extra £250 billion of value. I passionately believe we need to create a true level playing field for women to access our networks, support and finance. mnAI data helps Coast to Capital identify businesses, and gives rapid insights into local trends in far greater detail than is possible by conventional means.” With the right data sets, local councils and LEPs can: Actively identify and support female founders; Perform instant analysis to spot and monitor trends, activity and engagement within female entrepreneurs; Highlight hotspots for female-founded companies; Identify trends and gender breakdown within their region; Identify trends and hotspots in certain areas; Identify the number of female-led/male-led businesses it certain areas; Visualise growth within their regions. Access to this data helps LEPs to connect with female founders and start-ups, increasing their engagement with them and targeting funding where it is most needed. In the past local councils with business grants under schemes designed to support female founders have struggled to identify targets for their funding, but access to accurate data allows them to find and target the female business owners who fit the criteria. In addition to targeting certain groups, local authorities can also use data to ensure that they are consistently identifying, approaching, and engaging with the businesses who need their support, and providing equal support to all. Local Enterprise Partnerships and Growth Hubs can analyse data by geography and sector using it as a key element of the research, targeting, and support for businesses they engage with, and allowing them to review the businesses that they engage with to ensure that their CRM data reflects the engagement with limited companies. Using data to target businesses in need of support In addition to targeting certain groups, local authorities can also use data to ensure that they are consistently identifying, approaching, and engaging with the businesses who need their support, and providing equal support to all. Local Enterprise Partnerships and Growth Hubs can analyse data by geography and sector using it as a key element of the research, targeting, and support for businesses they engage with, and allowing them to review the businesses that they engage with to ensure that their CRM data reflects the

October 2021 Platform release

Our latest platform update is now live for all users. In our latest release, users benefit from a host of visual changes, features, and enhanced data sets. If you are new to us or want to explore mnAI for you or your team please contact us at sales@mnai.tech to book a demo.